5 Most Common Mortgage Questions- AND Answers!

If you're planning to buy a home, getting your financial footing is the first step in the process. After all, this is likely the biggest purchase you'll ever make, and It comes with a LOT of questions.

- How much will a home cost?

- What can you afford to spend?

- And where will the money come from?

While it's always a good idea to meet with a financial advisor to discuss the specifics of your situation, read on for starters.

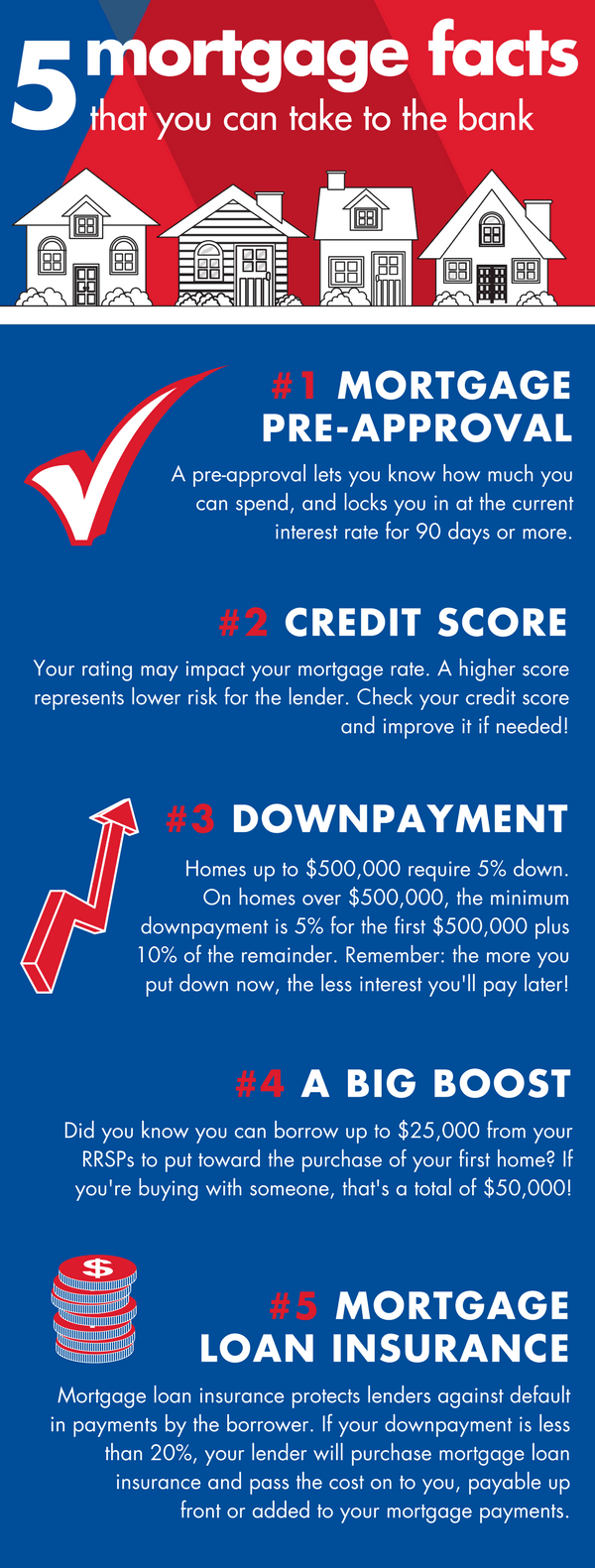

1. I'm thinking about buying my first home - Where do I start?

Logically, step 1 is to get pre-approved for a mortgage. A pre-approval lets you know how much you can spend, and locks you in at the current interest rate for 90 days or more, allowing you to shop with confidence. This is especially important in light of recent interest rate hikes and more rumoured in 2018, which may impact your mortgage rate and ultimately, your home-buying budget.

2. Can I buy a home with Zero Down Payment?

The down payment is an essential part of your purchase. There are private lenders who offer mortgages with zero down, but the interest rate will likely be much higher and will cost you much more over the life of your mortgage. This is generally not recommended. Don't cut corners and risk losing your investment. Save up at least five per cent of the purchase price. Reduce your home-buying budget to make it more affordable.

Aside from good ole scrimping and saving, you can also use the first-time Home Buyer's Plan to borrow from your RRSPs - tax free! Read this for more details: https://rem.ax/downpayment

3. Should I get Mortgage Insurance? How does it work?

There is a common misconception that mortgage loan insurance protects the borrower. This is not the case. Mortgage loan insurance protects the lender against default in payments by the homebuyer. If the buyer has a down payment of less than 20 per cent of the purchase price, the lender will purchase default insurance and pass that cost on to the borrower. It can be paid up front, or tacked on to the mortgage payments and stretched out over time. Mortgage loan insurance is offered by companies like Canada Mortgage and Housing Corp., Genworth Financial Canada, Canada Guaranty, or another approved private insurer.

4. How much do I need for closing costs?

Typically, closing costs can range from 1.5 to four per cent of the home's purchase price. These include legal and administrative fees that are payable at closing time. You can expect things like the home inspection fee, mortgage default insurance (if you down payment is less than 20 per cent of the purchase price), the Land Transfer Taxes, lawyer fees, appraisal fee and property taxes. Make sure you budget for closing costs. On a home priced at $500,000, the closing costs can range between $7,500 and $20,000.

5. Does a higher credit score mean I will get a better mortgage rate?

Yes, it's true! Your credit score is a measure of your financial health. According to the Government of Canada, your rating "indicates the risk you represent for lenders, compared with other consumers...The credit-reporting agencies Equifax and TransUnion use a scale from 300 to 900. High scores on this scale are good. The higher your score, the lower the risk for the lender." Thus, a higher rating will typically secure a better mortgage rate, since you're more likely to make your scheduled payments.

If you have a poor rating, do some damage control before you apply for your mortgage. Read this for more info: https://rem.ax/mortgage-application

6. How will the new mortgage rules affect me?

The new mortgage rules that took effect on January 1 now require that all mortgage applicants qualify at a rate that's two per cent higher than your contracted rate, or the Bank of Canada's five-year benchmark rate which currently sits at 5.14 per cent – whichever is higher. This is to ensure borrowers can continue making their mortgage payments even if interest rates rise, which has already happened in 2018 with more increases in the forecast. This is a very strong indication that interest rates WILL rise in the coming days, weeks, months and perhaps years.

As for the effects, it depends on your housing market! Click here to find out how the new rules are expected to impact housing markets from coast to coast.

.png)

.png)